California has finally taken a step to resolve the ambiguities and inconsistencies in the regulation of hemp-derived CBD — a move that could see the state setting a de facto national standard in light of continued inaction by the US Food & Drug Administration.

California has finally taken a step to resolve the ambiguities and inconsistencies in the regulation of hemp-derived CBD — a move that could see the state setting a de facto national standard in light of continued inaction by the US Food & Drug Administration.

Legislation passed in Sacramento this month governing hemp-derived CBD products provides some long-overdue clarity for producers, purveyors and consumers alike, who have all heretofore been operating in a legal gray zone.

Until now, the confused regulatory environment has led to what some have called a "Wild West" atmosphere in the Golden State's CBD sector.

On Oct. 6, Gov. Gavin Newsom signed Assembly Bill 45, which authorizes the use of hemp and hemp-derived cannabinoids in foods, beverages, cosmetics and pet products in the state. It also holds manufacturers to strict testing and labeling guidelines, similar to those in place for psychoactive cannabis products.

California already has a thriving market for CBD products, accounting for $730 million in sales in 2019 — two and a half times more than any other state.

The California Cannabis Industry Association (CCIA) welcomed the new law — with some caveats. In a statement, CCIA director Lindsay Robinson praised the bill's author, Assemblymember Aguiar-Curry, as "steadfast in her approach to create a level playing field between cannabis and hemp while protecting the health and safety of all Californians."

Robinson added, in words that implicitly acknowledge the new law's limitations: "AB 45 establishes a long overdue, comprehensive framework for the manufacture and sale of hemp products in California, but our work is not over. We look forward to working with the author on future legislation to establish a pathway for the incorporation of hemp into the cannabis supply chain."

Legacy of confusion

California policy on CBD has up to now been a muddle of confusion. And moves by the bureaucracy to provide some clarity have actually been met with protest by the hemp industry and CBD producers as only making things worse.

In July 2018, the California Department of Public Health (CDPH) issued a memo asserting that hemp-derived CBD extract was not legal for use in "food products" in the state. Only that derived from psychoactive cannabis was permitted, and to be regulated by the CDPH's Manufactured Cannabis Safety Branch.

The diktat only added to the confusion, which was even evident in the nomenclature used. The CDPH drew a distinction between CBD derived from "hemp" as opposed to "cannabis" — despite the fact that hemp is simply cannabis with 0.3% or less THC, by the federal government's definition. (Even use of the term "psychoactive" for THC-rich cannabis is contested by some, as CBD can also have a subtly mood-altering effect.)

But the memo was not actually a regulation — it was only an "FAQ" (Frequently Asked Questions) intended to clarify existing policy. And it failed to make clear if the prohibition only applied to use in food products or to hemp-derived CBD generally.

Amy O'Gorman Jenkins, a lobbyist for the California Cannabis Industry Association (CCIA) and president of Sacramento-based Precision Advocacy, tells Project CBD: "That ambiguity continued, and we saw sporadic and inconsistent enforcement, largely on food and beverage products."

In December of 2018, the federal Farm Bill legalized hemp-derived CBD, while maintaining the prohibition on that derived from THC-rich cannabis — but California's regulations did not change. This placed California's regs seemingly at odds with federal law on the question — barring CBD products derived from "hemp," but not those derived from "cannabis."

CBD derived from "cannabis" continued to be available in California's cannabis dispensaries — while the hemp-derived version was available, as elsewhere in the country, in pharmacies, convenience stores and gas stations. But these were generally produced out of state, and were effectively being marketed with no oversight. Following threats from local authorities, many retail outlets began to pull such items.

A 2019 study by Van Nuys-based cannabis-testing company CannaSafe Laboratories found that just 15% of the 20 products it tested contained the advertized amount of CBD, and that many were contaminated with adulterants — particularly solvents in vape products.

Inconsistent enforcement

The confused regulatory environment is also noted by Will Kleidon, chairman of California Hemp Council and CEO of CBD purveyor Ojai Energetics.

Although based in Ojai, Southern California's hub of New Age culture, the company actually manufactures in Nevada. "We figured out how to solubilize cannabinoids and patented the technique in 2014," Kleidon tells Project CBD. "Users will fell the benefits very rapidly. The patent applies to all cannabinoids, but we're just producing hemp-derived CBD, from our own genetic catalogue."

He says the company is primarily working with the Cherry Wine strain crossed with a ruderalis variety to produce a "Full Spectrum Hemp Elixer." This is a mix of hemp-derived CBD with other cannabinoids (within the legal THC limit) and herbs such as moringa, in a base of hempseed oil. The company also offers CBD extract in a base of coconut oil, as well as a line of topicals.

Kleidon describes what he calls the "inconsistent enforcement" retailers have faced in California.

"It came down to how local counties were interpreting the FAQ, because the CDPH didn't even make a reg," he relates. "It was different enforcement levels, from none to full tilt. Retailers were visited by agents form local jurisdictions. We had entire stores stop ordering from us, certain cafés stopped selling our products. You could still get them online anywhere in California, but they were pulled from some retailers."

Contacted by Project CBD, the CDPH said that the department's enforcement efforts on CBD products have "primarily focused on addressing consumer complaints." It stated that since passage of AB 45, "CDPH has not taken any enforcement actions against hemp-derived CBD products." In the statement, the department pledges to "work closely with stakeholders to help educate them" on the provisions of the new law so they can "successfully navigate the application and licensing process as it becomes available."

Clarity at last

When AB 45 hit Gov. Newsom's desk in September, Aguiar-Curry told Cannabis Wire that she'd been pushing for such legislation for years because she'd "grown increasingly concerned about the risk to public health from the sale of illegal, unregulated CBD products in our state.

.. My constituents have unwittingly been consuming these products for years and I wanted to provide regulated, tested alternatives and the jobs and economic activity that will come with this new law."

The new law explicitly allows CBD and other hemp-derived inputs or parts of the hemp plant to be included in food, beverages and cosmetics. Producers are required to register with the CDPH. The law also requires that hemp imports meet California standards and that out-of-state facilities submit to CDPH inspections. It bars the use of hemp-derived inputs in products that contain alcohol, tobacco or nicotine, notes a summary in the National Law Journal.

AB 45 also seeks to close the so-called Delta-8 loophole, under which some retailers are marketing the psychoactive cannabinoid Delta-8 THC, and asserting that it is legal because federal law only references the better-known Delta-9 THC. AB 45 creates a new definition for any "THC or comparable cannabinoid." This new category is defined thusly: "Any tetrahydrocannabinol, including, but not limited to, Delta-8-tetrahydrocannabinol, Delta-9-tetrahydrocannabinol, and Delta-10-tetrahydrocannabinol, however derived."

Heading off any attempt to find and exploit new loopholes, the CDPH is given the power to include within this definition "any other cannabinoid, except cannabidiol [CBD], that the department determines…to cause intoxication."

Progress, not perfection

Industry and advocates did not get everything they wanted in AB 45. The law maintains California's rigid firewall between the hemp and "cannabis" markets — at least for now. What the industry calls "co-mingling" will continue to be prohibited, meaning that hemp-derived inputs may not be used in THC-laden products, and not sold in cannabis dispensaries.

"That is frankly a very disappointing outcome of AB 45," says Amy O'Gorman Jenkins. "We fought for a regulatory path to sale of hemp-derived products in cannabis dispensaries. That was put off."

The law does call for the state Department of Cannabis Control to prepare a report on introduction of "hemp cannabinoids into the cannabis supply chain," to be turned in to the governor and Legislature by July 2022.

O'Gorman Jenkins notes with hope that Aguiar-Curry has pledged to begin working on a bill by early next year to "authorize incorporation of hemp cannabinoids into cannabis products and allow sale of hemp-derived products in cannabis dispensaries."

The upside of this firewall is that hemp-derived CBD products will be legally available statewide; that majority of California localities that currently ban cannabis dispensaries under the opt-out provisions of the 2017 Medicinal & Adult-Use Cannabis Regulatory Safety Act (MAUCRSA) will have no power to similarly ban hemp products. (That majority of jurisdictions that bar dispensaries tend to be in the more rural and sparsely inhabited areas of the state anyway.)

"Hemp-derived products will be available in traditional retail stores," says O'Gorman Jenkins. "But now they will be tested and appropriately labeled, and subject to rigorous advertizing standards, to help consumers be better informed about what they're consuming."

AB 45 gives CDPH seizure, embargo and recall powers over hemp-derived products, as well as inspection authority. It brings hemp ingestibles and topicals under the purview of the Sherman Food, Drug & Cosmetic Act, the primary California law governing this sector. It includes additional provisions that mirror the testing standards for contaminate levels in "cannabis," referencing those codes in the MAUCRSA.

AB 45 also bars sale of smokable CBD products (meaning CBD-rich low-THC dried flower) until a separate law imposing a tax on such products is passed by the Legislature.

Will Kleidon of Ojai Energetics expresses basic satisfaction with AB 45, even while sharing these reservations about its limitations. "You can't let perfection get in the way of progress," he says. "The overall enabling of hemp products to be sold in the state is a big step forward."

Until now, Ojai Energetics has been primarily sourcing from growers in Colorado. Following the passage of AB 45, Kleidon says the company plans to start growing its specialty hemp strains in California's Ventrua County with the next planting season.

A de facto national standard?

As California finally emerges from the legal and regulatory gray zone around CBD, confusion unfortunately persists at the federal level. Despite legalization of hemp-derived CBD in the 2018 Farm Bill, the US Food & Drug Administration has failed to promulgate regulations for CBD products — instead issuing dubious claims, such as that the cannabinoid may cause liver damage.

An unfortunately more legitimate preliminary study by the FDA last year again found many products containing CBD are mislabeled, containing either significantly more or less of the cannabinoid than advertized. Nearly a quarter of food products tested in the study failed to live up to label claims, according to an FDA summary of the report sent to the House Appropriations Committee obtained by Hemp Industry Daily.

While warning of the dangers of the lack of regulation, the FDA ironically continues to fail to regulate. This August, the FDA declined a request from producers of the famous CBD-rich strain Charlotte’s Web for approval of its products as dietary supplements. In its statement, the FDA cited its own 2018 approval of British-produced CBD-based Epidiolex as a prescription pharmaceutical for the treatment of seizures — arguing that this means the agency may not approve similar products for sale as dietary supplements.

Yet CBD products continue to be marketed nationwide — only regulated at the state level, and only in some states (now including California).

However, as we've seen with automobile emissions standards, California's huge market means that its enacted policies have the potential to impose themselves nationally on a de facto basis. California's assertion of its right to impose more stringent emissions standards than the federal government set off a state's rights battle — with conservatives (including the Trump administration) assuming the unlikely role of defending federal power.

Eric Steenstra, president of the national advocacy organization Vote Hemp, calls passage of AB 45 "a major moment for hemp in California, and what happens in California often becomes policy in other states."

Looking back on the crafting of the bill, Steenstra observes: "It took us three years to get AB 45 negotiated and come up with a plan to move this forward, while the FDA is still sitting on its hands. California is biggest marketplace in US, which is biggest marketplace in world for these products. So opening up this state in spite of the FDA is a huge win for the industry."

Cross-post to Project CBD

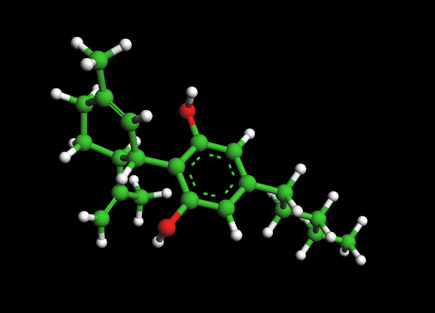

Image: World of Molecules

Recent comments

3 weeks 4 days ago

3 weeks 5 days ago

6 weeks 5 days ago

7 weeks 5 days ago

11 weeks 5 days ago

15 weeks 3 days ago

19 weeks 4 days ago

20 weeks 2 days ago

30 weeks 2 days ago

34 weeks 2 days ago